Today we’re going to talk about a guy I really admire, Breno Perrucho, the creator of the Jovens de Negócios channel. Breno is passionate about the world of investments and aims to share his knowledge to help young entrepreneurs prosper in their businesses. In one of his videos, he addresses a crucial topic for anyone who wants to have a healthy financial life: emergency savings.

What is an Emergency Reserve?

Breno begins the video by explaining the concept of emergency reserves. It defines it as an amount of money stipulated by each person, intended to cover the cost of living that you have during a certain period. This reserve is essential to deal with unforeseen situations, such as health problems in the family, layoffs or even the need to change residence.

How Much Do I Need for an Emergency Fund?

The question many ask themselves is: how much money do I need to have in my emergency fund? Breno suggests that we should consider our fixed costs and how long we want to have this financial insurance. He recommends that the emergency fund be sufficient to cover at least six months of expenses.

For example, if your monthly expenses with basic expenses such as food, rent, water, electricity, gas, cell phone/telephone and health/insurance bills total $2,500, you should multiply this amount by six (the number of months recommended by Breno ). This results in an emergency reserve of $15,000.

Where to Invest the Emergency Reserve?

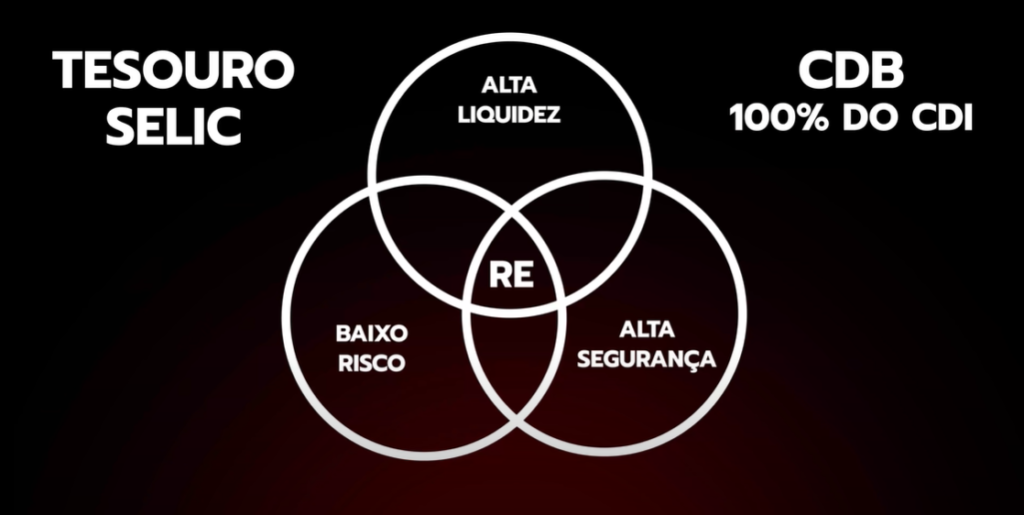

Choosing where to invest your emergency fund is crucial. Breno advises that the emergency reserve be invested in fixed income assets, which offer low risk and high liquidity. He mentions the Selic Treasury as a common and safe option, as it earns daily income and follows the Selic rate.

Breno also highlights Bank Deposit Certificates (CDBs) that yield at least 100% of the CDI as a good option for an emergency reserve. He specifically mentions Banco Inter’s daily liquidity CDB, which is a very affordable and profitable option available on the market. Furthermore, CDBs have the advantage of being guaranteed by the Credit Guarantee Fund (FGC), which means that, even if the bank goes bankrupt, the investor is guaranteed up to a limit of $250,000.00.

Another option mentioned is the Nubank interest-bearing account, which also yields 100% of the CDI and has the advantage of being easy to access for many investors.

Always remember that the choice of investment for the emergency reserve must take into account the ease of retrieving the money, as in an emergency situation, liquidity is a very important factor.

Conclusion

Breno Perrucho emphasizes the importance of planning to build an emergency reserve and choosing the correct investments for this purpose. He also highlights that, after completing the emergency reserve, the next step is to learn how to diversify the investment portfolio to ensure long-term profitability.

I hope this summary of Breno Perrucho’s video was useful to you. Remember, the key to financial security is planning and preparing for the unexpected. And, as always, it’s a pleasure to share Breno’s wisdom with all of you.

MoneySuite Emergency Savings Spreadsheet

If you are looking for an effective tool to help plan and monitor your emergency financial reserve, the MoneySuite Emergency Reserve Excel Spreadsheet sold in partnership with Dashboard Design may be the ideal solution for you.

This worksheet is a robust, interactive tool designed to motivate you to create and follow an effective financial plan. It allows you to track the progress of your emergency fund over time, which is a great motivation to stay focused on your financial goals.

Features of the Emergency Reservation Spreadsheet

MoneySuite’s Emergency Reserve Spreadsheet has several useful features:

- Emergency Reserve Calculator: This feature allows you to discover the ideal value for your emergency reserve and the time needed to reach it. Simply fill in the required fields to obtain a personalized estimate.

- Emergency Reserve Evolution: In this section, you can record the amounts deposited in your emergency reserve. It allows you to monitor the amounts deposited or invested, the current reserve balance, the established goal and the percentage of the goal achieved.

- Emergency Reserve Dashboard: This control panel has four main indicators – Deposited Amount, Current Balance, Target and % of Target. It also features two graphs for quick and easy viewing of progress. One graph shows the amounts deposited and the other shows the evolution of the emergency reserve in relation to the target.

Final considerations

Planning and maintaining an emergency fund is a crucial step towards financial stability. With MoneySuite’s Emergency Savings Spreadsheet, you can better organize yourself, set realistic goals, and track your progress.

FAQ – Frequently Asked Questions about Emergency Reservation

What is an emergency fund?

A: An emergency fund is an amount of money you save to cover unexpected expenses or financial emergencies. It serves as a “security cushion” for times of uncertainty or financial instability.

How much money should I have in my emergency fund?

A: The general recommendation is that your emergency fund is enough to cover at least six months of fixed expenses. For example, if your monthly expenses total R$2,500, your emergency fund should be R$15,000.

Where should I store my emergency fund?

A: Your emergency fund should be kept in a safe and easily accessible place. This can be a savings account, an investment in Treasury Selic, a CDB with daily liquidity or even the interest-bearing Nubank account.

Should I invest my emergency fund?

A: Yes, but it is important to choose low-risk and highly liquid investments. The goal is not to earn high returns, but rather to preserve the value of money and ensure it is available when you need it.

How can I calculate the ideal amount for my emergency fund?

A: The ideal amount for your emergency fund depends on your monthly expenses. Add up all your fixed monthly expenses and multiply the total by six. This will be the ideal amount for your emergency fund.

How can I build my emergency fund?

A: Start by defining the amount you need for your emergency fund. Then determine how much money you can save each month and start making regular deposits into your savings.

What should I do after completing my emergency fund?

A: After completing your emergency fund, you can start investing in other areas, such as shares, real estate funds or even in your education and personal development.

Can I use my emergency fund to make investments?

A: No, the emergency fund should only be used for emergencies. If you use this money to invest and the investment doesn’t work out, you may end up with no money to cover unexpected expenses.

What do I do if I need to use my emergency fund?

A: If you need to use your emergency fund, do so. But remember to start rebuilding it as soon as possible.

How can MoneySuite’s Emergency Savings Spreadsheet help me?

A: MoneySuite’s Emergency Reserve Spreadsheet is a tool that helps you calculate the ideal amount for your reserve, track your deposits and view your progress through an intuitive dashboard. It is an excellent tool for anyone who wants to organize themselves and have greater control over their emergency fund.